KUALA LUMPUR Nov 2. Non-tax revenue is expected to contribute 326.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Firstly this research will determine the linear or non-linear relationship between individual and corporate tax revenue and tax rate.

. As a developing nation the country heavily depends on FDI for its economic development. The good thing is that the government is also keen on listing credits and deductions that help lower ones tax liabilities. I n Malaysia indirect taxes include import and export duties sales tax service tax excise duties tourism tax etc.

13 rows Malaysian ringgit. The statutory body who is in charged with the direct tax is the Malaysia Inland Revenue Board LHDN. 10 percent for Sales Tax and 6 percent for Service Tax.

What supplies are liable to the standard rate. Income tax is a direct tax regulated under Income Tax Act 1967. The Inland Revenue Board IRB is responsible for the overall administration of direct taxes in Malaysia at the moment.

Income Tax Act 1967 ITA Other Malaysian non-Labuan entities deriving income from Malaysia are subject to tax under the ITA where the usual rate of tax applicable to companies is currently 25. Meanwhile in 2020 direct tax is expected to account for 506 of federal government revenue while indirect tax will contribute 168. Saravana Kumar and Nur Hanina Mohd Azham of Rosli Dahlan Saravana Partnership discuss a recent High Court ruling that a business sale agreement is subject to nominal not ad valorem stamp duty.

Direct payment to the stamp duty counter. KUALA LUMPUR Jan 20. TYPES OF TAXES IN MALAYSIA Direct taxes Paid directly by those on whom it is levied.

The tax is paid directly to the government. Malaysia is generally receptive to FDI. KUALA LUMPUR Aug 31 The direct and indirect tax collection stood at RM674 billion or 562 per cent of the target and RM248 billion or 59 per cent of the target respectively as of July 2021 the Ministry of Finance MoF said.

A direct tax is a tax that is levied on a person or companys income and wealth. ATXB213 MALAYSIAN TAXATION I 8. Income Tax RPGT Stamp Duty and Petroleum Income Tax.

The tax rate imposed for direct tax mainly both individuals and corporate sector in Malaysia do not generate higher tax revenue thus affecting the revenue and economic growth indirectly. A tax audit is an event carried out by the IRB to ensure that the taxpayers have declared their income in full and computed the appropriate amount of tax in accordance with the prevailing tax laws and legislation. It said the estimated tax revenue collection target for 2021 is RM1621 billion which is 103 per cent of Gross.

Malaysias tax revenue is estimated to register RM1747 billion in 2018 with direct tax collection constituting 764 of the total according to the Ministry of Finances Economic Outlook 2019 report released today. Therefore this research focuses on four core aspects. Sales Tax Service Tax and GST.

A certain percentage is taken from a workers salary depending on how much he or she earns. Example of direct tax. Sales Service Tax SST Sales tax is a single-stage tax charged on taxable goods manufactured in or imported into Malaysia by a taxable person and is due when the goods are sold disposed of or first used with a total sale value of more than RM500000 in 12 months.

While for indirect taxes the responsibility of collection is taken by the Royal Customs and Excise Department. In comparison in 2019 direct taxes made up 506 of government revenue while indirect taxes and non-tax revenue made up 173 and 317 of revenue. The Inland Revenue Board of Malaysia achieved a new record in direct tax collection last year with RM137035 billion collected which is 1113 or RM13723 billion more than the RM123312 billion collected in 2017 the Ministry of Finance MoF said today.

Examples of direct tax are income tax and real property gains tax. FDI in 2019 amounted to RM317 billion with. Direct taxes are collected by the Inland Revenue Board IRB and includes taxes such as income tax on individuals income tax on corporations petroleum income tax stamp duty and real property gains tax.

Type of indirect tax. However as of July 2021 the taxes collected totaled only. Direct Tax Income tax.

Jan 19 2022 In 2020 the total amount of direct tax revenue in Malaysia amounted to around 11511 billion Malaysian ringgit a decrease from the previous year. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST. Generally there are two 2 types of tax audits that are carried out by the IRB which are as follows.

An income tax is a government tax imposed on individuals or entities tax payers that varies with the income or profits taxable income of the tax payer. Indirect taxes Collected via third party. A non-resident individual is taxed at a flat rate of.

Types of Direct Taxes 1. Meanwhile indirect tax is referred to as tax excised to a person who consumes the goods and. Taxpayer wins case over business sale agreements in Malaysian court S.

Example of indirect tax. The Malaysian Government targeted to collect an estimated RM1621 billion worth of taxes for the year 2021 consisting of RM120 billion direct taxes and RM421 billion indirect taxes. Income tax It is based on ones income.

The Malaysian government revenue. However it has been proposed that the rate be. What is the outlook for foreign investment in Malaysia.

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Business Income Tax Malaysia Deadlines For 2021

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

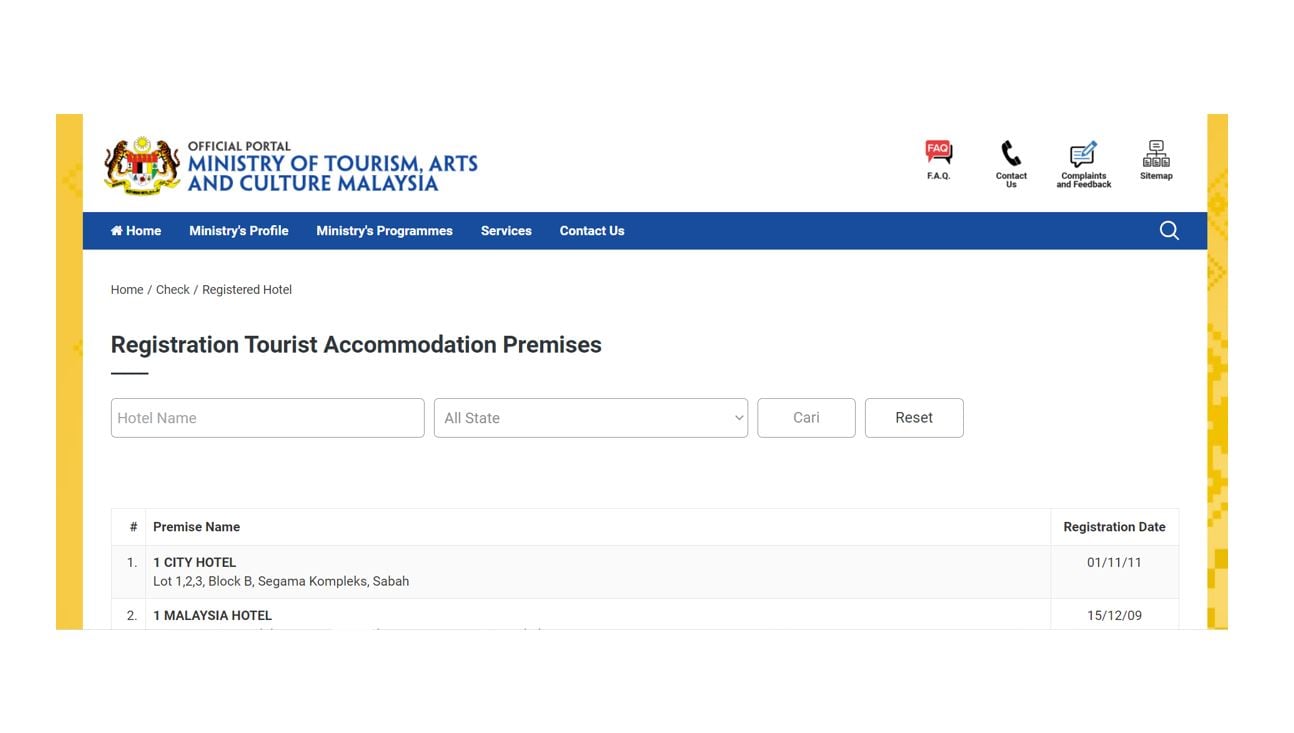

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Malaysian Personal Income Tax Pit 1 Asean Business News

How To File Your Taxes For The First Time

Cukai Pendapatan How To File Income Tax In Malaysia

到底几时要报税 2017年income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

How To Calculate Foreigner S Income Tax In China China Admissions

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

7 Tips To File Malaysian Income Tax For Beginners

Business Income Tax Malaysia Deadlines For 2021

Personal Income Tax E Filing For First Timers In Malaysia Mypf My